Emily Green yesterday detailed the story of Cadiz, the California company that wants to pump groundwater from the Mohave desert and sell it into Southern California’s coastal municipal and industrial market.

CALIFORNIA Governor Arnold Schwarzenegger has endorsed plans by private speculator Cadiz, Inc to tap Mojave ground water, reports the Los Angeles Business Journal. The Cadiz plan, according to a statement from the governor, “will sustainably recover more than one million acre feet of water that would otherwise be lost to evaporation and make it available to help provide a reliable source of water for Southern California.”

At first blush, this would seem like a sensible use of market mechanisms to deal with water problems – willing seller, willing buyer, price set, water delivered. But, in fact, Green’s analysis of the story illustrates two fundamental market failures.

The first is what the economists call “rent-seeking behavior” – the actions of private individuals to distort markets by persuading governments to act in a way that has the effect of subsidizing the action at hand. Cadiz, as Green argues, has this problem in spades, with close associates of the company’s owner placed in key positions throughout government in an apparent effort to influence government decisions favoring the project.

The second involves environmental externalities: side-effects of the project that are not captured in the water’s price:

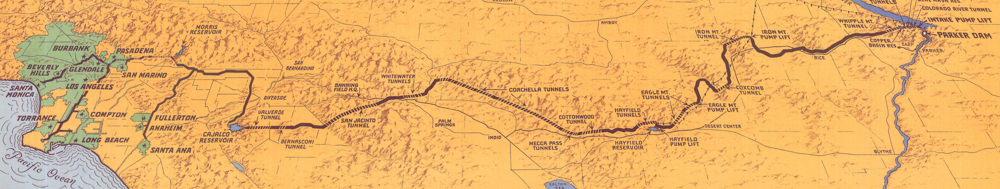

[Q]uantity of water was also a challenge. In 2002, the Colorado River entered what the US Bureau of Reclamation river masters now call the worst drought of the last 100 years. There was no extra river water to bank in Cadiz’s private aquifer.

This left the option of pumping Mojave ground water water out from under Cadiz land and selling it to Metropolitan and its agencies. Except that so little water flows into the Mojave through rain and snowmelt every year, this option would mean swift collapse of delicate desert ecosystems.

In fact, markets work in relatively predictable ways. Absent intervention to prevent things like this, markets deliver failures like Cadiz with some regularity.

Boy, John, I hope the bot programs don’t find this post, then the lonely pale white conservative men don’t flock here in droves and shout you down for denigrating their religion.

[/snark]

Best,

D

The first is what the economists call “rent-seeking behavior” – the actions of private individuals to distort markets by persuading governments to act in a way that has the effect of subsidizing the action at hand. Cadiz, as Green argues, has this problem in spades, with close associates of the company’s owner placed in key positions throughout government in an apparent effort to influence government decisions favoring the project.

John,

Isn’t this what every organization (private, public, PAC, and non-profit) do all the time in an attempt to get the government to pay attention to them. ACORN comes to mind.

The LA Business Journal story mentioned that Cadiz had unnamed water districts, presumably Met member agencies, lined up as customers. Those names will not be get-able until business opens next week, so I didn’t go into it in an already complicated story. But it’s reasonable to suspect that interested local entities include the Los Angeles Department of Water and Power, of which Mayor Villaraigosa is head.

One thing became clear when Cadiz sued Metropolitan and Brackpool’s association with the LA Mayor became more ostentatious than ever. Cadiz isn’t going quietly. The English Brackpool, who has a criminal record in the UK, does not plan to leave California without his gold.

After failing to get control of the board of the nation’s largest water wholesaler, then suing Metropolitan (also unsuccessfully), Brackpool is now working Met’s agencies individually during a drought.

So, from the look of it, this is not simply a case of a lobbyist trying to weight the scales of government to further a certain cause or business agenda, but the opening of a Phase II effort to divide and conquer the government entity that couldn’t be bought whole.