There’s a truism in water politics and policy in the western United States that “water flows uphill to money”. But is it correct?

I ran across it most recently in an excellent editorial in the Salt Lake Tribune regarding the Southern Nevada Water Authority’s proposal to build a pipeline to rural Nevada, along the Utah border, to ferry water to Las Vegas. The Tribune editorial board makes a reasonable point – that once folks in Vegas spend all that money to build a pipe, it may be difficult to enforce regulations designed to throttle back the pumping if it looks like it’s harming the “move from” area:

But experts rightly caution that by the time the wells sound the alarm, it could be too late to reverse the damage. Besides, once Las Vegas has invested in a $3 billion pipeline and pumping system, it will not give up the water willingly. In the West, water inevitably flows toward population and money.

As I said, I think it’s a reasonable concern. But is the inevitability described in the last sentence really the case? I’m inclined to think that, in the West, water flows uphill to money, except when it doesn’t.

There are good examples, especially in California, where water is quite literally flowing uphill toward wealthy water users. I’m thinking here about the agricultural users in the western San Joaquin Valley and the urban users of Southern California, who draw heavily on the troubled Sacramento-San Joaquin Delta for their water supplies. They appear willing and quite able to use their wealth and influence to move water to meet their needs.

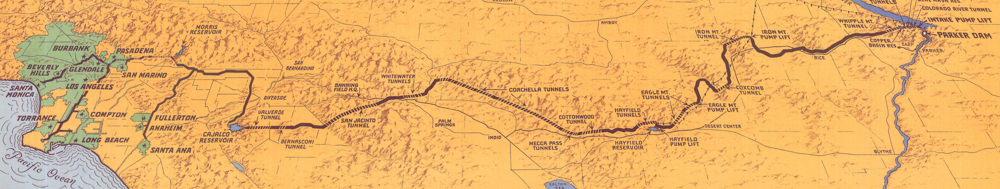

The Cadiz project in California also appears to have a lot of the “uphill to money” characteristics.

But there are counter-examples. I’ve written in the past about cases in New Mexico, most notably the big Augustin Plains proposal (a lot like Cadiz or Snake Valley in Nevada) where state water law has thus far blocked efforts to pump water “uphill to money”. In fact, as Bettina Boxall wrote last week in the LA Times, it’s not entirely clear that money will be sufficient to move the Cadiz water along its very uphill journey.

And my favorite example, as I’ve written about at some length, is the federal government’s decision back in 2003 to cut LA’s allocation of Colorado River water. That was a decision against shipping water uphill to the wealthiest on two counts. First, on an interstate basis, it represented a decision to cut wealthy California’s overall allocation of Colorado River water in deference to the other less wealthy and politically powerful states in the basin. Second, within California, it represented a decision to cut wealthy urban-suburban Southern California’s water supply while preserving the water rights of less affluent and less politically powerful Imperial Valley farming interests.

In the latter examples, legal structures to manage water rights held firm under the pressure of wealthy and powerful interests that would have preferred to move water “uphill to money”. So what are the characteristics that distinguish between the two outcomes?

“once folks in ***** spend all that money to build a pipe, it may be difficult to enforce regulations designed to throttle back the pumping if it looks like it’s harming the “move from” area”

Some say us “Delta” folks are conspiracy theorists.

I think this kinda covers it. No ?

Also to China: http://online.wsj.com/article/SB10000872396390444517304577653432417208116.html

dg

Chris – Thanks. I don’t think Delta folks are conspiracy theorists to worry that once the billions are spent on the Peripheral Thingie, there will be enormous pressure to fill it. But the 2003 MWD example is evidence that does not always happen. Met’s LA Aqueduct has been running half full for a long time, so in that case whatever pressure there might have been to fill it failed.

“Forget it, Jake; it’s Chinatown”

Update: LA Times 10/7 http://www.latimes.com/news/local/la-me-delta-farmers-20121005,0,7417204,full.story

Pingback: Another Week of GW News, October7, 2012 – A Few Things Ill Considered

Good post, intriguing point. But I can’t help but believe that water projects are approved not on efficiency but how much influential people would make from them. Otherwise, we’d be pushing a lot harder on conservation.

I’m sure this is nitpicking and that your reference to the Quantification Settlement Agreement was general, but I still wonder if the QSA isn’t more an example of water changing path uphill to money rather than a triumph of law over greed. The QSA didn’t cut Southern California’s allocation of Colorado River water, but forced its swelling suburbs and Metropolitan it to stay within it and stop surplus-hogging to the tune of 1mafy and higher. While completed under the Bush administration, the heavy lifting involved getting So Cal back within its allocation was done under Bruce Babbitt (an Arizonan) with fierce lobbying from Southern Nevada. The idea was that Vegas and Phoenix etc should also enjoy upper basin overflows to more evenly cover the Southwest with suburbs. But then as the QSA happened, the Colorado flows became less generous and the surpluses dried up anyway. Southern California loves to cry about how it endured the “hard landing” but the really hard landing happened in the Sacramento San Joaquin Bay Delta, where Met steadily intensified its withdrawals to compensate.

Meanwhile, when the long lobbied-for surpluses didn’t happen for Vegas, it dusted off its Great Basin pipeline concluding in Snake Valley, which it had waved since 1989 at Interior saying, in effect, “Give us more Colorado River water or the Great Basin gets it.” (You’ve got to love Pat Mulroy’s theatrics, it’s taken a German to give the West a good modern Western.) But this was bluster. Once Vegas claimed much of the groundwater still legally claimable in the state of Nevada, the Great Basin was always going to get it. Since 2002, it’s just been targeted sooner and harder. Vegas has every intention of filling its pipeline and has set up a monitoring program designed to fail, so it can stay full. Expect the pipe to sprout plenty of laterals when it’s built. Vegas is insatiable; the model championed by Mulroy is that growth will sustain growth. Conservation sustains growth when there’s a drought between projects.

Cadiz is a project that at inception more than a decade ago was riding the fashion for storing surface water in groundwater basin, but at its heart stands to enrich a small number of people by mining the Mojave carbonate aquifer and shipping the proceeds in public infrastructure. Given much changed Met leadership, it’s very likely that Cadiz will wheedle and get permission to do this, and the numbers involved will be heavily finesssed. There are tragic ramifications for the Mojave, but desert tortoises don’t write cheques. Financing? Cadiz CEO Brackpool is a notorious wheeler-dealer. There’s a trail of bankruptcies behind him stretching clear to the City of London, but I wouldn’t bet against him pulling this thing off, or it having wholly predictable ruinous impacts. He has swiped the bar codes of just about every politician dealing with Western water and now armed himself with lawyers expert in perverting compliance.

We the public in the Lower Basin and in the upper Basin in Utah where Vegas pipes will drain its groundwater are at critical juncture in policy-making. We have to decide if wrecking the Great Basin’s Snake/Salt Lake flow system, wrecking the White River flow system, wrecking the Cadiz region, wrecking the Colorado River estuary, wrecking the Sacramento San Joaquin Bay Delta and then allowing the pumpers to replace wrecked steady state systems with self-monitored mitigation is acceptable.

I have no way of knowing if the punnel proposed by Met necessarily will exacerbate withdrawals by increasing capacity or if it’s in fact an adaptive management tool as advertised. But it is being revived at a time when wrecking the environment is being argued more fiercely than ever as good for business and the mitigation schemes being offered are paper mills run by sophists.

Short of a lot of people waking up to the urgency of UCLA geographer Glen MacDonald’s cry for region-wide watershed management, wreckage is our business plan. In this, water is often pumped uphill to money.

Emily – Thanks, I don’t disagree with anything you’ve said (except maybe a quibble back over QSA). But it still doesn’t completely answer my question – because we really do have some places in this discussion where the water hasn’t flowed uphill to money, even if there are lots of places that it has. So it seems to me the answer to the great question you close with, regarding how we might manage our way out of this mess, still might be illuminated by thinking more about those cases where the water didn’t flow toward the money.