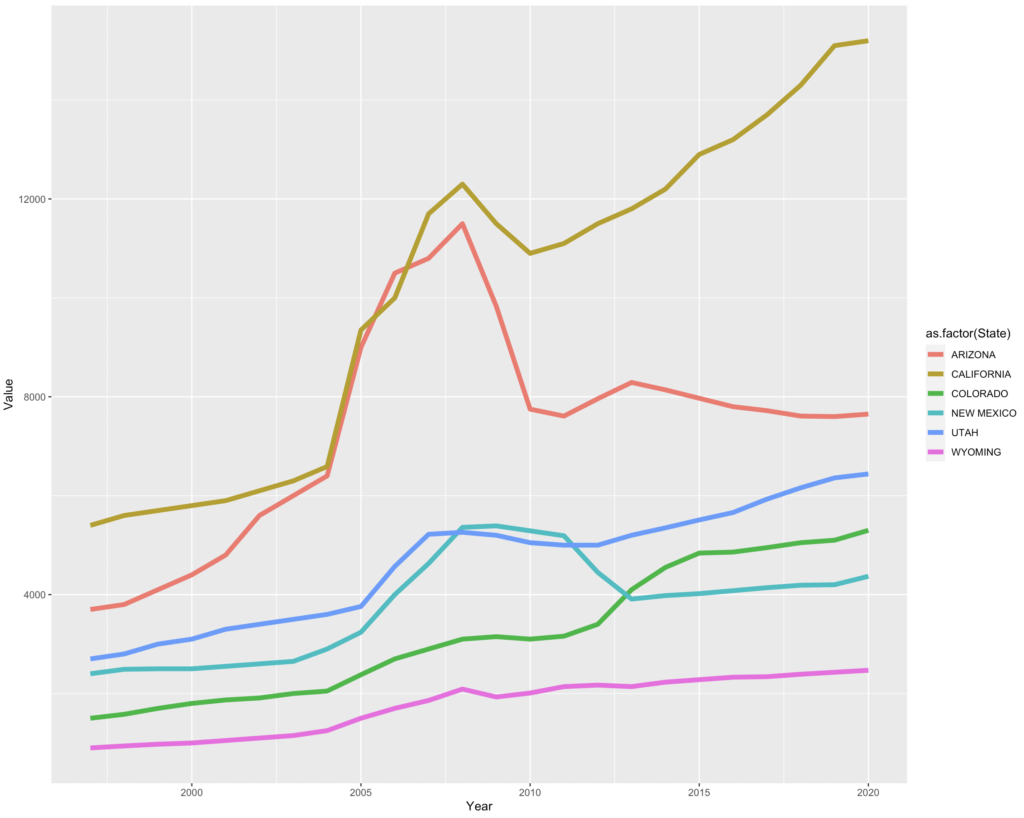

New US Department of Agriculture report out this week shows the dollar value per acre of irrigated California cropland continuing to rise:

Price per acre, in dollars, of irrigated cropland. Source: USDA NASS

Above is a quick plot of the data for six of the seven states included in the Colorado River Basin. THIS IS NOT COLORADO RIVER BASIN IRRIGATED ACREAGE. Large areas of many of these states are outside the Colorado River Basin. Much of California’s irrigated acreage, for example, is in the Central Valley and elsewhere.

I’m intrigued by:

- California’s inexorable rise, despite the public policy discourse conventional wisdom that the Safe Groundwater Management Act will lead to a significant reduction in acreage now irrigated with groundwater. Maybe “the market”, whatever that is, thinks differently?

- Arizona’s flat (so declining with inflation, I haven’t added an inflation adjustment). Still quite valuable relative to the other states, but perhaps continued evidence of decline of irrigated ag in the central part of the state?

- The implications of climate change for these curves – I would hypothesize that as climate change reduces surface water flows the relative value of land that can be irrigated with groundwater would go up. Until policy changes (SGMA) or physically running out of (cheap) water bends the curves back down.

Source: USDA NASS

Disclosure: I’m not an economist, just some random blogger halfway through breakfast on a Friday morning.

There is a flattening in California’s irrigated land value at the very end of the data (2019 onwards).

SGMA did not become a reality until very recently — as you know the actual SGMA plans were to be filed by Jan 31 of this year.

In the development of the GSA plans, there was a large amount of magical thinking (we will find a source of water with which to replace the groundwater overdraft…).

Moreover, the political pushback against SGMA also began to appear in public this Spring.

So, the market may now be showing some acknowledgement. of SGMA.

No graph John

Price of farmland in New Mexico is three times what the graph shows in certain areas. and without water.

FYI, it’s the “Sustainable Groundwater Management Act.”

I have read multiple news stories in 2018 and 2019 of declining appraisal values in Kern and Tulare Counties, in the southern San Joaquin Valley, where mining groundwater has for years been the predominant supply. I suspect that this decline is hidden in the aggregate. Multiple other shoes to drop in the coming years.

Pingback: Many thoughtful comments on my musings on California groundwater regulation and agricultural land value – jfleck at inkstain

California land values may be reflective of either 1) actual transactions or 2) current production. Transactions would reflect either sales of land that is likely to have sufficient water rights from either surface or aquifer sources. Land without sufficient water supply is being offered for sale to solar PV developers who often pay a premium on current value of the land. Production is currently unaffected by SGMA and probably won’t be until late in the decade at the earliest. In any case, under SGMA it will almost certainly be marginal lands that retired first. How that land is counted as “agriculture” will affect the price index.

The large bump in AZ land values between the mid-90s and 2008 was due to ag land being purchased by developers (primarily in Maricopa County) and being converted to urban landscape.