Investing in land leveling – Creative Commons license CC PDM 1.0 by USDAgov.

A guest post by David Rosenberg.

David E. Rosenberg

Utah State University | david.rosenberg@usu.edu | @WaterModeler

The term buy-and-dry plays to the fears of farm and ranch communities. Wealthy urban water providers buy up water rights, dry out farms and ranches, encourage people to retire to Hawaii or other locales, and export the purchased water out of basin to growing cities. As more farmers and ranchers sell their water rights, local businesses—irrigation, farm equipment, seed, and other agricultural firms—contract. Those contractions encourage more farmers and ranchers to sell their water rights and farms. And a negative feedback loop gains momentum and propels a tragedy where the commons—a functioning local agricultural community—disappears. Deep-pocketed public urban water providers can initiate the perverse cycle of buy and dry and so can private Wall Street investment bankers (Howe, 2021).

We can reverse the perverse cycle of buy and dry.

- Require farmers and ranchers that take payments for their water to invest some of that money in farm water conservation efforts, and

- Keep transactions temporary.

Temporary is already part of the Upper Colorado River Basin’s new conservation motto of temporary, voluntary, and compensated (Upper Colorado River Commission, 2019). Here, temporary means to lease agricultural water rights for a single year or part of a season. Next year, decide again whether to lease based on hydrologic conditions. Income from temporary water rentals can help farmers or ranchers bridge difficult years. Or they can use the lease period to upgrade equipment, level land, incorporate manure, or make other improvements that are difficult when crops are present. Temporary leases give farmers and ranchers flexibility.

When we require farmers to invest lease payments in farm water conservation, we keep the money in the local community. Farmers and ranchers will reach out to local business for help to monitor and meter flows, improve farm water delivery, purchase more drought tolerant seeds, switch to crops that increase yield with less water, or find technical assistance for conservation. Local businesses will invest proceeds from those sales in new agricultural and conservation products to serve their customers’ needs. There will be growth. Keeping payments in the local community turns the feedback loop positive. Keeping payments in the local community keeps farmers farming and ranchers ranching. A local community survives or maybe thrives.

Outside organizations that want to lease water plus the numerous canals, districts, states, and other entities that deliver water to farms and ranches have multiple reasons to require recipient farmers to invest in farm water conservation. When an outside organization requires a farmer or rancher to invest lease payments in farm water conservation, the outside organization empowers farmers or ranchers to make more water available to lease in future years. Canal companies, districts, and states that require recipient farmers to invest payments in farm water conservation keep lease payments for water within their service areas. These water management entities will also have an interest to oversee transactions, help aggregate numerous smaller transactions by their member agencies or individual users, and regulate water flows out of their service areas.

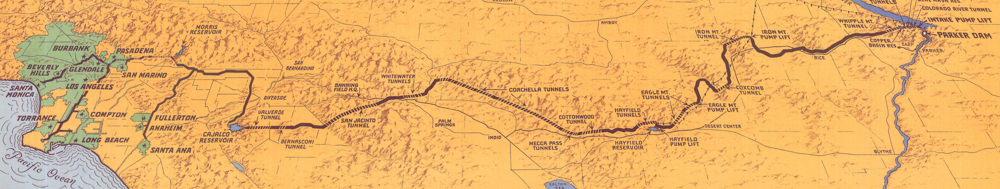

California’s 2003 Quantification Settlement Agreement (QSA) is an example of investing payments for water in agricultural water conservation. There were some good aspects of the agreement and undesired outcomes. One good aspect was that California’s Imperial and Coachella Irrigation Districts used some $1-2 billion in payments from San Diego County Water Authority and Metropolitan Water District of Southern California over 18 years to partially line the All-American canal and completely line the Coachella canal. Another good aspect was the irrigation districts used payments to recover tailwater, improve irrigation application uniformity, automate canals and farm turn outs, install soil moisture sensors, and more finely schedule water deliveries. In exchange, the urban water districts took delivery of up to 300,000 acre-feet per year of conserved water through the Colorado River aqueduct. The State of California and U.S. Federal Government also signed on to the deal. An undesired outcome was that deliveries to Imperial Irrigation District declined as did farm runoff and drainage and tailwater flows to the Salton Sea. The Salton Sea shrank. Problems of dust, outmigration, and ecosystem harm increased. The story of the 2003 Quantification Settlement Agreement is a cautionary tale to mind the system-wide effects to lease water to outside entities. Involve water organizations from the very local on up.

If individual farmers or ranchers complain that requiring them to invest in farm water conservation impacts their financial freedom, they should consider the alternatives. First, continue the status quo where there are few out-of-district compensated water transfers, temporary or permanent. Second, out-of-district transfers become more common as more and more neighbors permanently sell their farm and their water rights to cities or investment bankers.

Buy and dry sounds scary and is scary. But individual farmers and ranchers, outsider buyers, and the canals, districts, and states that manage water can work together to curtail buy and dry. These organizations can require their users or member agencies who lease water to invest some of the lease payments in farm water conservation. Investments in farm water conservation will keep money in local communities and encourage farmers and ranchers to start conserving now, build a conservation ethic, and grow conservation efforts over time.

Data Availability

No data, models, or code were generated for this blog post.

Acknowledgements

Niel Allen, Eric Kuhn, David Tarboton, and one other person who asked to remain anonymous provided comments that improved the blog post.

References

Howe, B. R. (2021). “Wall Street Eyes Billions in the Colorado’s Water.” New York Times, BU, Page 1.

Upper Colorado River Commission. (2019). “Request for Qualification-Based Proposals for Professional Services.” RFP #2019-01-UCRC.